Yes! You can use AI to fill out Form SSA-44, Medicare Income-Related Monthly Adjustment Amount - Life-Changing Event

Form SSA-44, Medicare Income-Related Monthly Adjustment Amount, is used to request a reduction in your Medicare premiums if you've experienced a life-changing event that affects your income. This form is important to ensure that your Medicare costs reflect your current financial situation.

Our AI automatically handles information lookup, data retrieval, formatting, and form filling.

It takes less than a minute to fill out Form SSA-44 using our AI form filling.

Securely upload your data. Information is encrypted in transit and deleted immediately after the form is filled out.

Form specifications

| Form name: | Form SSA-44, Medicare Income-Related Monthly Adjustment Amount - Life-Changing Event |

| Form issued by: | Social Security Administration |

| Number of fields: | 54 |

| Number of pages: | 8 |

| Version: | 12-2023 |

| Form page: | https://www.ssa.gov/medicare/lower-irmaa |

| Official download URL: | https://www.ssa.gov/forms/ssa-44.pdf |

| Language: | English |

Instafill Demo: filling out a legal form in seconds

How to Fill Out Form SSA-44 Online for Free in 2025

Are you looking to fill out a SSA-44 form online quickly and accurately? Instafill.ai offers the #1 AI-powered PDF filling software of 2025, allowing you to complete your SSA-44 form in just 37 seconds or less.

Follow these steps to fill out your SSA-44 form online using Instafill.ai:

- 1 Visit instafill.ai site and select Form SSA-44.

- 2 Enter your personal information and Social Security Number.

- 3 Select your life-changing event and date.

- 4 Provide your adjusted gross income details.

- 5 Sign and date the form electronically.

- 6 Check for accuracy and submit the form.

Our AI-powered system ensures each field is filled out correctly, reducing errors and saving you time.

Why Choose Instafill.ai for Your Fillable Form SSA-44 Form?

Speed

Complete your Form SSA-44 in as little as 37 seconds.

Up-to-Date

Always use the latest 2025 Form SSA-44 form version.

Cost-effective

No need to hire expensive lawyers.

Accuracy

Our AI performs 10 compliance checks to ensure your form is error-free.

Security

Your personal information is protected with bank-level encryption.

Frequently Asked Questions About Form Form SSA-44

Form SSA-44 is used to request a reduction in your income-related monthly adjustment amount (IRMAA) for Medicare Part B and prescription drug coverage premiums if you have experienced a major life-changing event that has resulted in a decrease in your income.

Life-changing events for Form SSA-44 include marriage, divorce/annulment, death of a spouse, work stoppage or reduction, loss of income-producing property, loss of pension income, and employer settlement payment.

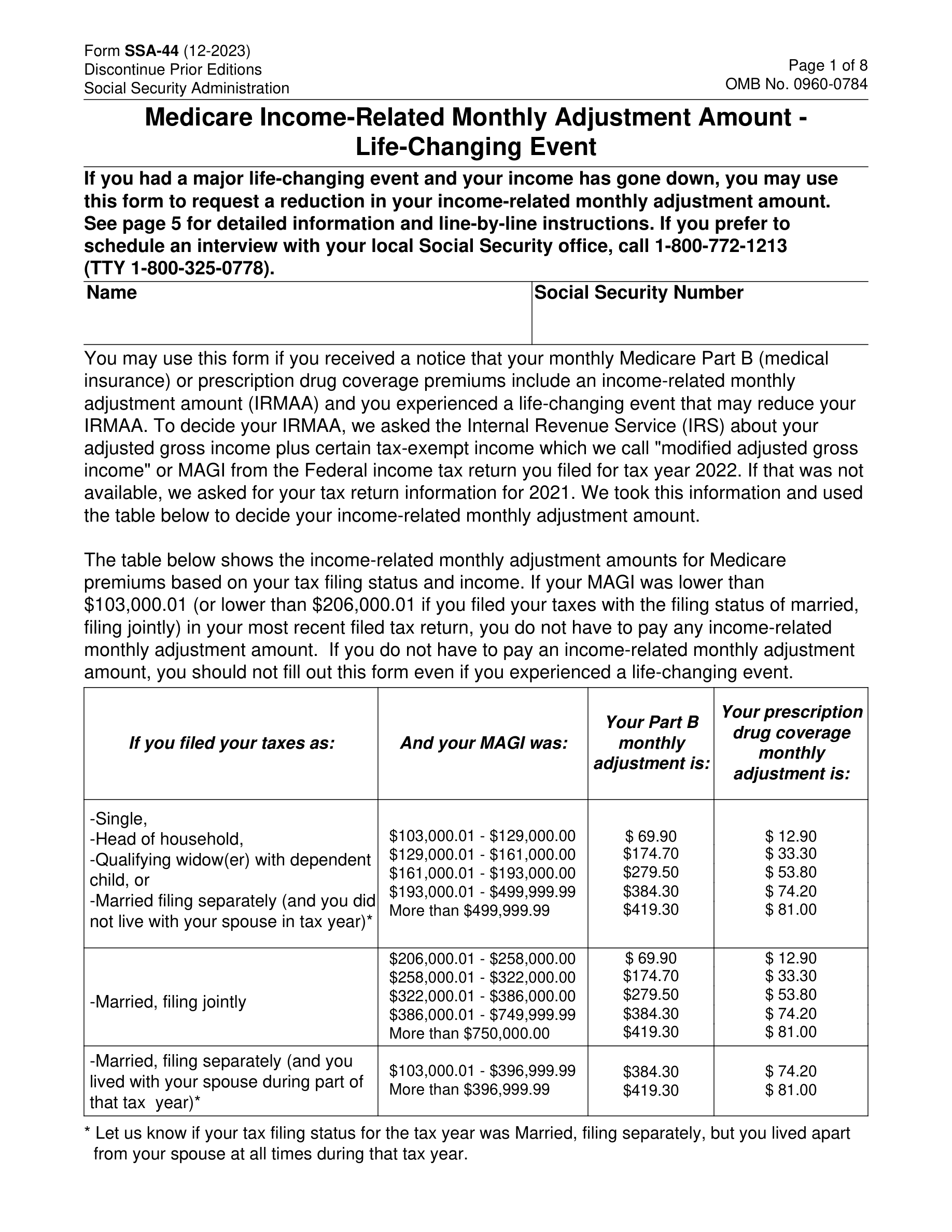

You need to pay IRMAA if your modified adjusted gross income (MAGI) is above a certain threshold based on your tax filing status. If your MAGI was lower than $103,000.01 (or $206,000.01 if filing jointly) in your most recent tax return, you do not have to pay IRMAA.

You need to provide your name, Social Security Number, type of life-changing event, date of the event, tax year in which your income was reduced, adjusted gross income, tax-exempt interest income, and tax filing status for the relevant tax year.

Yes, you can provide estimates of your adjusted gross income and tax-exempt interest income if you have not yet filed a tax return for the relevant year. However, you must provide a signed copy of your tax return when you file it.

You must attach evidence of your modified adjusted gross income (MAGI) and the life-changing event, such as a copy of your Federal tax return, marriage certificate, divorce decree, death certificate, or other relevant documents.

If you expect your MAGI to be lower in the year following the submission of Form SSA-44, you should complete Step 3 of the form to provide an estimate of your income for that year.

You can submit Form SSA-44 by mailing or bringing the completed form to your local Social Security office. The office is listed under U.S. Government agencies in your telephone directory, or you can call Social Security at 1-800-772-1213 (TTY 1-800-325-0778).

If your income estimate changes or you amend your tax return for that reason, you need to contact the Social Security Administration to update your records. Failure to do so may result in corrections later, including retroactive assessments or refunds.

If you have questions about completing Form SSA-44, you can call the Social Security Administration at 1-800-772-1213 (TTY 1-800-325-0778) or visit your local Social Security office.

Compliance Form SSA-44

Validation Checks by Instafill.ai

1

Full Name and Social Security Number Verification

Ensures that the full name and Social Security Number provided on the form match those on the individual's Social Security card. This is crucial for accurate identification and to prevent any discrepancies that may arise during the processing of the form.

2

Life-Changing Event Selection

Confirms that exactly one life-changing event is selected, as required by the form instructions. This check is important to ensure that the form is not rejected due to multiple selections, which can cause confusion and delay the adjustment process.

3

Life-Changing Event Date Format

Verifies that the date of the life-changing event is provided in the correct format (mm/dd/yyyy). This standardization is essential for consistency and to avoid any misunderstandings regarding the date of the event.

4

Tax Year for Reduced Income

Checks that the tax year when income was reduced due to the life-changing event is clearly stated. This information is necessary to assess the adjustment amount accurately.

5

Adjusted Gross Income and Tax-Exempt Interest Income Reporting

Ensures that the Adjusted Gross Income (AGI) and Tax-Exempt Interest Income for the specified tax year are correctly entered. This data is critical for calculating the income-related monthly adjustment amount.

6

Tax Filing Status Selection

Confirms that a Tax Filing Status for the tax year in question is selected. This is important as it can affect the calculation of the adjustment amount.

7

Expected MAGI for Next Year

Verifies that if the Modified Adjusted Gross Income (MAGI) is expected to be lower in the next year, all fields in STEP 3 are completed with estimated figures. This projection helps in determining the adjustment for the upcoming year.

8

Documentation Attachment

Checks that evidence of the MAGI and the life-changing event is attached or will be presented to an SSA employee. Proper documentation is essential for the verification of the life-changing event and the income information provided.

9

Signature Presence

Ensures that the form is signed by the applicant, as an unsigned form is not valid. The signature is a declaration that the information provided is accurate to the best of the applicant's knowledge.

10

Contact Information Completeness

Confirms that a current address and phone number are provided for contact purposes. This information is necessary for any follow-up communication that may be required.

11

Evidence of Life-Changing Event

Verifies that the evidence provided for the life-changing event is acceptable and relevant. This is crucial for substantiating the claim of a life-changing event.

12

Correct Tax Year Usage

Ensures that the correct tax year is referenced throughout the form, as per the instructions. Using the correct tax year is vital for the accurate calculation of the adjustment amount.

13

Form Submission to Local Social Security Office

Confirms that the form is submitted to the correct local Social Security office or through the provided contact numbers. Proper submission is necessary for the form to be processed.

14

Declaration Reading Confirmation

Verifies that the declaration has been read before signing. This is important to ensure that the applicant understands the terms and the information they are providing.

15

Form Completion Check

Performs a final review to confirm that all steps have been completed and all required information has been provided. This comprehensive check minimizes the risk of the form being returned for incomplete information.

Common Mistakes in Completing Form SSA-44

A common mistake is entering the wrong date for the life-changing event. It's crucial to double-check that the date is accurate and formatted correctly (mm/dd/yyyy). To avoid this error, cross-reference the date with official documents related to the event before submitting the form. An incorrect date can lead to processing delays or the rejection of the application.

Applicants often mistakenly check more than one life-changing event. It's important to select only ONE event that applies to you. Review the list carefully and choose the event that most accurately reflects your situation. If you're unsure which event to select, consult with a professional or contact the Social Security Administration for guidance.

Filling in the wrong tax year for the reduction in income is a frequent error. Ensure that you enter the correct tax year that corresponds to the life-changing event. This information is vital for the SSA to assess your application accurately. If you're uncertain about the tax year, refer to your tax documents from that period or seek assistance from a tax advisor.

Misunderstanding how to calculate the Modified Adjusted Gross Income (MAGI) can lead to incorrect figures on the form. To prevent this, carefully review the instructions for calculating MAGI, which includes your Adjusted Gross Income plus any tax-exempt interest income. Use your tax return from the relevant year as a reference to ensure accuracy.

Applicants sometimes forget to attach evidence of the MAGI and the life-changing event. This oversight can result in the form being returned or delayed. To avoid this, compile all necessary documents before filling out the form and attach them as instructed. If you're submitting the form in person, present the documents to an SSA employee.

Choosing the wrong tax filing status can affect the evaluation of your application. Make sure to select the tax filing status that you used for the tax year in question. If you've had a change in marital status or other circumstances that affect your filing status, verify the correct status with a tax professional or the IRS before completing the form.

A common oversight is failing to sign the form. Your signature is a necessary component of the application process. Review the form before submission to ensure that you have signed it. Remember that an unsigned form is considered incomplete and will not be processed.

Leaving out your phone number or mailing address can hinder the SSA's ability to contact you regarding your application. Ensure that you provide current and accurate contact information. Double-check the numbers and address for typos before submitting the form.

Some applicants mistakenly use outdated or unofficial forms. Always use the official SSA-44 form from the Social Security Administration. You can obtain the latest version from the SSA website or a local SSA office to ensure that you are providing information on the correct document.

Submitting the form to an incorrect Social Security office can delay the processing of your application. Verify the address of your local Social Security office or call the provided numbers for assistance on where to submit the form. This ensures that your application reaches the right hands promptly.

Saved over 80 hours a year

“I was never sure if my IRS forms like W-9 were filled correctly. Now, I can complete the forms accurately without any external help.”

Kevin Martin Green

Your data stays secure with advanced protection from Instafill and our subprocessors

Robust compliance program

Transparent business model

You’re not the product. You always know where your data is and what it is processed for.

ISO 27001, HIPAA, and GDPR

Our subprocesses adhere to multiple compliance standards, including but not limited to ISO 27001, HIPAA, and GDPR.

Security & privacy by design

We consider security and privacy from the initial design phase of any new service or functionality. It’s not an afterthought, it’s built-in, including support for two-factor authentication (2FA) to further protect your account.

Fill out Form SSA-44, Medicare Income-Related Monthly Adjustment Amount - Life-Changing Event with Instafill.ai

Worried about filling PDFs wrong? Instafill securely fills ssa-44 forms, ensuring each field is accurate.